Compare car insurance

- Truly independent, most complete

- Lowest price guarantee

- Unique discounts until 15%

Enter your license plate number, postal code, and date of birth. Also provide the number of kilometers you drive annually and your no-claim years.

Use the comparator to determine which coverage suits you and your car best: liability, limited casco, or fully comprehensive.

Compare the widest range of car insurance options. At the top, you'll find the insurance that best matches your needs in terms of price and quality.

Found the best car insurance? Apply for it directly via Geld.nl and wait for our confirmation email. If you have provisional coverage, you can hit the road immediately!

There are many different car insurers, each with their own premiums and conditions. Comparing all car insurance policies by yourself therefore can be quite a task. Fortunately, Geld.nl has made finding the right car insurance much easier. With our independent comparison, you can compare the most comprehensive range of car insurance options in the Netherlands in just one minute. This way, you are guaranteed to find the best car insurance at the lowest premium!

Why compare your car insurance? Here's why:

On Geld.nl, you can compare up to 20 car insurers and their different car insurance policies. This allows us to offer you the most comprehensive car insurance comparison in the Netherlands. Whether you're looking for a third party only, a third party, fire & theft or a comprehensive car insurance (all risk), you'll always find the best and cheapest car insurance for your situation in our comparison tool.

Last updated: September 25, 2024

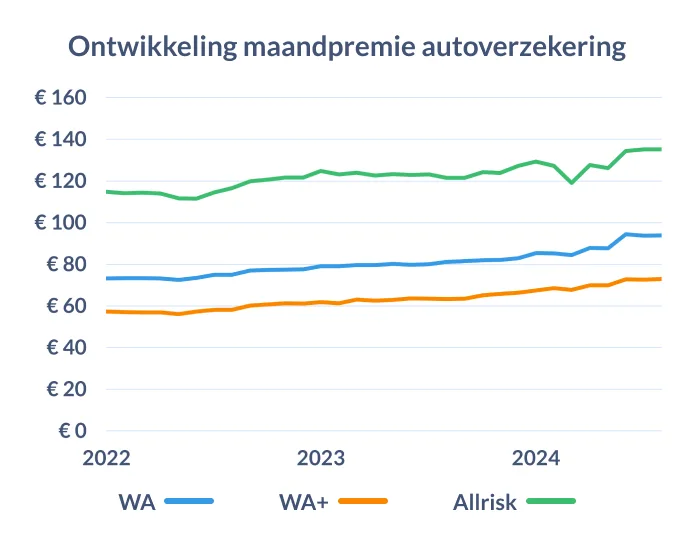

Currently, car insurance premiums are increasing significantly. The average premium for car insurance is now over 10% higher than at the beginning of 2023. The increase is caused by factors such as rising claim payouts, higher repair expenses, and inflation. As cars become more advanced and parts more expensive to replace, we expect this upward trend to continue throughout the year. At the same time, the differences in premiums between insurers are also growing. For example, the difference between the cheapest and the most expensive third party only insurance is over € 73 per month. Comparing car insurance helps you find the best and cheapest option for you.

Insurers consider various factors when determining the premium for your car insurance, such as:

Insuring a new, heavier car is more expensive than an older, lighter model.

Insurers see young drivers as a high risk group because they are more likely to be involved in accidents. Therefore, in general, the older you are, the lower your premium. However, from the age of 70 and up, premiums increase again.

If you live in an area with fewer accidents, car thefts, or vandalism, your premium will be lower. It also matters whether you live in a city or a rural area. In a more populated area, the risk of damage is greater.

The more kilometres you drive a year, the higher the risk of damage, and therefore the higher your premium.

If you have been driving for a long time without any claims, you will receive a discount on your premium. However, if you have accumulated many claim-free years and don't want to lose them, consider adding a no-claim protector to your policy. This allows you to make one claim a year without losing your claim-free years.

The more extensive the coverage, the higher the premium. That's why third party only insurance is usually the cheapest and all-risk insurance is the most expensive option.

An electric car is more expensive to insure than a hybrid or fuel-powered car because the parts of an electric car are the most expensive to repair. Additionally, electric cars and hybrids are often heavier, and heavier cars tend to cause more damage in accidents, which also leads to higher premiums.

Unsure whether to choose a third-party liability insurance, limited comprehensive insurance, or fully comprehensive insurance? Check out the key differences between the three types of car insurance and determine the coverage that suits you best.

Is your car over 10 years old? Then its value has already significantly decreased. A liability car insurance (WA) is often the best and most affordable choice. WA stands for legal liability. A WA coverage only reimburses damage you cause to other cars. As a driver, you are required to have at least this insurance.

If your car is between 6 and 10 years old, a WA limited casco insurance is often the most cost-effective option. This covers damage to others and protects your own car against costs from fire, theft, burglary, storms, glass damage, and collisions with animals. If you get a large discount due to no-claim years or if your car still has significant value, a fully comprehensive coverage (allrisk) may be more attractive.

If your car is less than 6 years old and/or worth more than € 10,000, opt for fully comprehensive insurance (allrisk). This covers almost everything. If you cause damage, both the damage to the other party and the damage to your own car will be reimbursed. You will also receive enough compensation for major damage to repair your car or buy a new one.

In addition to affordable car insurance, you can also find supplementary car insurance on Geld.nl. These additional coverages protect you from various driving risks, shielding you from unexpected costs.

This supplementary insurance provides legal support if you get into a legal conflict after an accident, such as who is liable or how much damage you’ll receive compensation for.

This supplementary coverage compensates damage to people and items inside your car, even if you caused the accident.

Many car insurers cover accessories in your car up to a certain amount, usually up to € 1,000.

With this option, you can claim damage once a year without it affecting your no-claim years or the premium you pay.

With a roadside assistance insurance, you can quickly get back on the road in case of car trouble, both in the Netherlands and abroad.

The premium for car insurance is different for everyone. However, to give you an idea of the costs, here are the top 5 cheapest car insurance options per coverage type right now.

| Top 5 third party only insurance | |

| Insurer | Premium / month |

|---|---|

| € 26.37 | |

| € 28.30 | |

| € 30.41 | |

| € 37.86 | |

| € 38.91 | |

| Top 5 third-party, fire and theft | |

| Insurer | Premium / month |

|---|---|

| € 30.94 | |

| € 31.59 | |

| € 31.75 | |

| € 32.29 | |

| € 32.40 | |

| Top 5 All-risk | |

| Insurer | Premium / month |

|---|---|

| € 50.75 | |

| € 53.58 | |

| € 54.85 | |

| € 58.16 | |

| € 58.61 | |

Paul Huibers, our car insurance expert, shares his advice: "Car insurers re-adjust their premiums annually. As a result, that affordable car insurance you had last year can now be more expensive. Your situation also changes every year. Your car gets a bit older, and you may have earned another year of no-claims. My advice is: get your car insurance recalculated once a year. This way, you can see if you still have the best car insurance, maybe you'll even find that your premium can be lower. Our data shows that customers who compare and switch save an average of € 260 per year on their car insurance. That's money you’d prefer to keep in your pocket instead of paying it to the insurer."

Curious about updates on car insurance? Sign up for our newsletter. This way you will receive useful advices and stay well informed to make smart choices!

We regularly ask our customers if they are satisfied with our services, with the goal of continuously improving our website and your experience. Below, you can find our most recent reviews rated 4 or 5 stars.

When comparing car insurance, first determine which coverage best suits your situation and vehicle. Based on that, you can choose a third-party liability insurance (WA) that only covers damage to others, or a more comprehensive WA+ or fully comprehensive insurance that also covers damage to your own vehicle. Then, compare various car insurance options on Geld.nl. Be sure to consider not only the lowest premium but also the policy terms. The deductible and no-claims discount, for example, can affect your overall costs, meaning that the cheapest car insurance might actually turn out to be more expensive in the end.

Take into account these aspects when choosing the best car insurance:

Yes. As soon as you register a car in the Netherlands it is mandatory to be insured, according to the Dutch Motor Vehicle Liability Act. However, it is up to you to decide how comprehensive you want your coverage to be and which additional insurance options you want to choose. The minimum required is liability insurance. If you cause an accident, this insurance covers the damage to others. If you want to be covered in case of damage to your own vehicle, such as theft or vandalism, you can opt for third party, fire & theft or all-risk coverage.

Interested in knowing which car insurance is right for you? Fill in our comparison tool and receive a free comparison on the best and most affordable car insurance options for you.

The premium you pay for your car insurance depends on several factors, such as the type of car you drive, your age, your location, and how many years you have been driving without making claims. Therefore, the costs of car insurance vary for each person. There is no one-size-fits-all cheap car insurance.

Your chosen coverage also affects the price. Depending on your personal situation and preferences, the costs of your car insurance might differ. Wondering if your current car insurance could be cheaper? Let Geld.nl help you find out by calculating your premium and comparing quotes from different insurers, ensuring you get the best deal.

Are you between 18 and 24 years old and want to insure your first car? Comparing car insurance is also a smart way to save money in this case. Insurers see people under 25 as a higher-risk group, which is why young drivers pay significantly more than older drivers with more experience. However, premiums can vary greatly between insurers. Compare the cheapest car insurance for young drivers on our platform!

The best car insurance is different for everyone. It depends on factors such as where you live, your age, how many claim-free years you have, how much you drive, and the size and age of your car. Based on these details, we first assess which coverage suits you best.

Generally, for cars that are 10 years old or older, the basic third-party liability insurance is the most affordable. If your car is between 6 and 10 years old, a more comprehensive third-party, fire, and theft insurance is advisable. For cars that are under 6 years old, an all-risk insurance policy is recommended as it covers nearly all types of damage. Once you have determined your desired coverage, you can then compare all available car insurance options that match your needs.

You can easily filter the various insurance options based on the criteria that matter most to you. If you're primarily looking for a cheap car insurance policy, sort by the lowest premium to immediately see the most affordable options for you. If you want the best balance of price and quality, sort by the best value for your premium. This way, you'll find the absolute cheapest car insurance with the conditions that matter most to you, ensuring you choose the best new car insurance policy!

Do you also want to find a good and affordable car insurance policy via Geld.nl? Use our comparison tool and have your affordable car insurance calculated.

You can request this information from your current or previous car insurer. Your no-claim years are recorded in the central Roy-data database, which every insurer in the Netherlands is connected to. If you switch insurers, you can transfer the no-claim years from your old insurance policy to the new one.

The central system that tracks these no-claim years is currently being updated. In the future, the no-claim years will be visible in real-time, not only when switching insurers. Since the development of this new system has been delayed, it's unclear when this will be implemented.

If you switch your car insurance, make sure your new insurer correctly transfers your no-claim years. This way, you’ll receive the correct discount on your premium.

If you've driven a company car, ask your employer for a statement detailing the number of no-claim years and bring it with you to your new car insurance. You must have been the sole driver of the vehicle for this to apply.

As a comparison site, we know that comparing your car insurance every year is the quickest way to save on your car insurance. But we also have some other advice to help you save:

Switching car insurance is easy and can often result in a lower premium. Start by comparing car insurance options on Geld.nl. Once you find the policy that suits your car best, you can sign up for it directly through our website. After that, cancel your current car insurance.

Most insurers allow instant cancellations. Some may even offer help in switching insurers, where they handle the cancellation of your current policy for you, making the process even easier. Always check the terms of cancelling your old policy to avoid being double insured.

Want more details on switching? Read 'What to keep in mind when switching car insurance.'

With some insurers, you can only cancel your car insurance after the first year of your contract, while others allow cancellation from day one. The cancellation notice period varies, ranging from a month to a daily cancellation option.

If your car is sold, stolen, or scrapped, you can often cancel the insurance immediately. Additionally, if your insurer raises your premium, you can also cancel your policy right away.

You are also entitled to a 14-day cooling-off period during which you can cancel the policy without incurring any costs.

No, an insurer is not obligated to accept your application for car insurance. Insurers have the discretion to decide which customers they want to insure and can reject an application for various reasons, such as a poor claims history or a record of non-payment.

However, if one insurer rejects your application, it does not mean that other insurers will do the same. In such cases, you can refer to our car insurance comparison tool to find another insurer that might offer you the best alternative and apply for a cheap car insurance policy there.

When you purchase a car, you apply for car insurance. Since it may take a few days for your application to be fully processed and approved, insurers typically offer temporary coverage. This ensures your car is immediately insured after submitting your application, even if your policy hasn't been finalized yet.

This provisional coverage allows you to drive without concern while the insurer assesses your application. If your application is approved, you will receive your official policy.

At Geld.nl, we clearly explain which insurers offer temporary coverage and how to obtain it when taking out your car insurance.

A car insurance policy with a deductible means that in the event of damage to your own car, you pay a portion of the costs yourself before the insurer reimburses the remaining amount. This type of insurance with a deductible can only be taken out with a third-party, fire, and theft insurance or an all-risk car insurance policy. The basic third-party liability insurance only covers the damage you cause to others' vehicles or property and does not cover any damage to your own car. Therefore, a deductible does not apply to this type of policy.

The terms of the deductible vary depending on the insurance policy, but it is usually paid per claim. Generally, the higher the deductible, the lower your monthly premium will be. This is appealing if you want to reduce the cost of your car insurance, but it also means that in the event of damage, you'll have to pay more out of pocket.

Therefore, weigh the lower premium against the amount you would have to pay in the event of a claim. Also, keep in mind that certain types of damage, such as glass damage, may have a different deductible.

The premium for car insurance is different for everyone. That's why we ask you to fill in some details about yourself and your car when comparing car insurance. We also ask which coverage you prefer. Based on that information, we provide you with an overview of the possible car insurance options for you. The cheapest car insurance will be listed at the top.

Curious if that cheap insurance is the best choice? You can sort the comparison by the best price/quality ratio to see which car insurance offers the best value in terms of both premium and terms.

When determining the price/quality score of car insurance, we consider the following factors in addition to the premium:

Yes, it is possible to insure your car in the Netherlands as a non-Dutch resident, but there are some conditions you should be aware of. Many Dutch insurers require that the car is registered in the Netherlands and that you have a Dutch address or a Dutch residence permit. Some insurers may also ask for a Dutch bank account for payment.

On Geld.nl, you can easily compare car insurance quotes to see which insurer best meets your needs.

There are many different car insurers, each with its own premiums and terms. Comparing all car insurance options yourself can be quite a task. Fortunately, Geld.nl has made choosing the right car insurance much easier. With our independent comparison, you can compare the widest range of car insurance offers in the Netherlands in just one minute. This way, you’ll find the best car insurance at the lowest premium!

Currently, car insurance premiums are rising significantly. The average premium for car insurance is already over 10% higher than at the beginning of 2023. Causes for this increase include rising claims costs, higher repair costs, and inflation. As cars become more advanced and parts become more expensive to replace, we expect this upward trend to continue this year. At the same time, the differences in premiums between insurers are also increasing. For example, the difference between the cheapest and most expensive third-party liability car insurance is more than € 73 per month. Comparing car insurance helps in finding the best and cheapest car insurance for you.

Insurers look at several factors when determining the premium for your car insurance, such as:

You start by comparing your car insurance by determining which coverage suits you. If you drive an older car with a low market value, third-party liability insurance (WA) is often the best and cheapest choice. WA stands for legal liability. This insurance is the minimum you must have as a driver. A WA insurance only covers the damage you cause to other vehicles. This is sufficient if your car is older and has already significantly depreciated in value.

With the more extensive coverage of a third-party, fire, and theft (WA limited comprehensive) insurance, your own car is protected against theft, window damage, storm damage, and burglary. And if you’ve just bought a new car, it’s better to go for fully comprehensive (all-risk) insurance. This offers the most extensive coverage, including damage to your own vehicle, even if you caused it yourself. Want to know more? Read 'Which car insurance suits me?' to learn how to choose the best coverage.

In addition to cheap car insurance, you can also find additional car insurance options at Geld.nl. With the additional coverage of these insurances, you cover various risks of driving a car. This protects you from unexpected costs.

These are the most commonly chosen additional coverages:

Every day, thousands of car owners compare their car insurance on Geld.nl. This makes sense, as we are an truly independent comparison platform, closely monitoring the developments in car insurance premiums. We share our knowledge on this topic through news articles. You can also regularly see our car insurance expert, Paul Huibers, in the media discussing car insurance.

On Geld.nl you can compare the most complete range of car insurance policies in the Netherlands. This means that in the comparisons on Geld.nl you see insurers that you don’t see on other comparison sites. This is why you can be sure that you will find the best and cheapest car insurance pertaining to your situation on Geld.nl. The complete overview of insurers that we include in our car insurance comparison can be found here: overview of car insurers.

You can compare car insurance policies on Geld.nl completely free of charge. We have made agreements with many insurers so that you can apply for the car insurance of your choice directly during the comparison process. For taking out car insurance, we receive compensation from the insurer of an average of € 37.50 per year per insurance.

There are some insurers that we don’t work with. However, this has no influence on the results of the car insurance comparison.

We offer you a 100% impartial car insurance comparison. We show you the car insurance policies that are available based on your wishes and preferences. You then compare and choose which car insurance you want to apply for. You can usually apply for the car insurance of your choice directly online. We also have certified experts available to answer all your questions and help when you make a comparison.

But that is not all. We give a part of our earnings back to you. We do this by giving you a gift when you take out a car insurance using Geld.nl. In addition, we offer you unique discounts up to 15% off the premium on some car insurance policies.

Are you switching car insurance? Then we are not allowed to cancel your current car insurance for you. We however do offer you our convenient switching service through which you can cancel your old car insurance yourself.

Before you make a car insurance comparison, we first ask you to provide us with relevant information about you and your car. You also choose what level of coverage you want for your car insurance. We will then show you the car insurance policies that are available to you based on this information.

You will always see the cheapest car insurance, with the lowest premium, at the top of your comparison. You can also sort the car insurance policies yourself by price/quality.

Furthermore, you can use the filters to adjust the comparison based on criteria you consider important such as coverage and payment term. This way you will always find a suitable and cheap car insurance for your situation and wishes.